The insurance industry has remained a constant in our society for centuries. But that industry, like all others, has had to adapt to a growing digital transformation. That’s where insurance technology, or insurtech, is offering up new innovations to make things easier for customers, brokers, and everyone in between. With this new technology, insurance companies across the United States are getting themselves better situated within the marketplace to stand out amongst their competitors.

What is insurtech?

Beyond having a variety of insurance options for customers, it’s important to have algorithms in place that benefit all parties involved in an insurance-related transaction. Insurtech refers to the innovations created and implemented to improve efficiency in the industry. Insurance technology powers the creation, distribution, and administration of business across various lines of coverage. With these technological innovations, large insurers have been able to explore new options outside traditional human efforts. This ranges from a dynamic pricing system based on market conditions to a better understanding of customer behavior.

Some solutions are related to quotations, payment options, and claims solutions. Appetite solutions within insurance technology help brokers to find a specific policy for a client across a range of providers. This improves the efficiency rate for agents, making for easier transactions across insurance companies. With new data solutions, the insurance industry is leveraging their sources within their systems for better connections. This is also beneficial for insurance professionals and prospective clients alike for the quoting process, and for insured parties within the claims management process.

What are the components of this technology?

The insurtech field relies on a variety of technologies to drive greater progress in the digital era. Artificial intelligence (AI) is changing the customer experience and business experience alike by automating human functions for quicker and more accurate responses in a faster time. Within AI, there is machine learning (ML). Insurance companies collect vast amounts of data that can extract valuable information. Collected data can be risk modeled through machine learning to help better assess potential losses in the future, with modeling that provides greater estimates for premiums for consumers.

Within the insurtech realm, there is what’s referred to as the internet of things (IoT) technology. For example, car insurance providers may offer trackers to better understand drivers’ habits behind the wheel from speed to braking patterns. The data collected from this technology is used by actuaries within insurance companies to better understand driving risk within certain age groups or in certain regions of the U.S. With data analytics, insurers can get deeper insights into customer needs and how to better the claims process, allowing for easier development than ever before.

What are the key applications of insurtech?

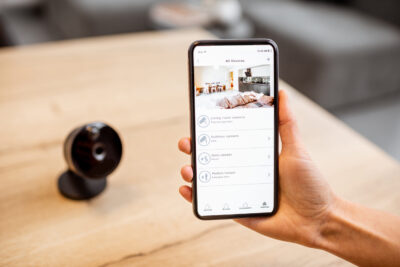

Within the insurtech community, there are key applications that are changing things for insurers regardless of the line of coverage or the size of the organization. There is the verification of identity process, allowing insurance companies, reinsurers, and brokers alike to have the assurance that they are keeping private information confidential with the right customer. This makes for more secure control over customer records with the assistance of smartphone apps, making fraud risk and detection easier than ever.

Insurtech is also expediting the claims process, allowing insured parties to file claims faster and have them paid out or addressed sooner. With this automation protocol, different types of insurance are seeing advancements for their customer bases. This automation is also pushing for the creation of smart contracts, creating automated protocols for simple documents for authentication and negotiation. This reduces the likelihood of fraud and increases customer satisfaction. Overall, insurtech continues to make strides that are making the benefits of an insurance policy more plentiful than ever before.